Release from 06.03.2025

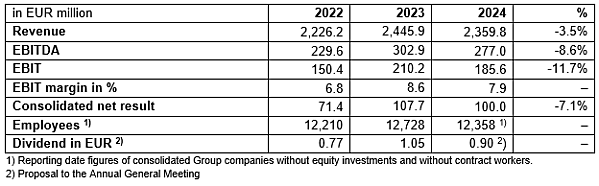

- Revenue of EUR 2.36 billion, EBIT of EUR 185.6 million and consolidated net result of EUR 100.0 million.

- High resilience thanks to broad industry and regional diversification

- Proposal for second-highest dividend since the IPO in 1999: EUR 0.90 per share

Bergheim, Austria. March 6, 2025

PALFINGER AG looks back on a very successful fiscal year. In 2024, revenue of EUR 2.36 billion and an operating result of EUR 185.6 million were achieved. The targeted reduction in working capital at the end of the year generated a strong free cash flow of EUR 119.5 million, enabling a further reduction in net financial debt.

Diversification as a stability factor

As a global champion, the company is excellently positioned, regionally diversified and successful with a broad product portfolio. The "In the Region, for the Region" approach strengthens PALFINGER's resilience to currency fluctuations, trade barriers, and supply chain challenges.

"The waste management and recycling, forestry, public sector, marine, as well as transportation and logistics industries are becoming increasingly important and already accounted for 65% of revenue in 2024. This diversification was a key factor in last year's success," explained Andreas Klauser, CEO of PALFINGER AG.

The international markets showed mixed development: In NAM, willingness to invest was restrained due to the presidential election in November, which weakened demand in the second half of the year. At the same time, the supplier structure in Mexico was expanded to prepare for future growth in NAM and further optimize the cost structure.

Thanks to the strong order intake in LATAM, capacities in Brazil and Argentina were increased. While there is no recovery in sight in China, India is emerging as an important future market in APAC. To strengthen market presence and customer loyalty in this region, a new assembly plant is being built in India, with an investment of more than EUR 25 million. Around 180 employees will be employed at this plant, where the focus will be on assembling loader cranes, hooklifts and aerial work platforms. A revenue of EUR 300 million is targeted by 2030 in the APAC region.

In Marine, profitability was significantly improved. Orders for offshore wind farm projects in Taiwan and Japan contributed to the overall success. The production capacities in Löbau, Germany, were modernized and expanded, and production started at the new plant in Niš, Serbia. Strong growth in marine and the tail lift business largely compensated for the decline in EBIT in the EMEA region.

Strong fourth quarter in EMEA gives confidence

The fourth quarter of 2024 showed an increase in order intake, particularly in the EMEA core markets of France, Germany and Scandinavia.

Innovation as a driving force

With an R&D expenditure ratio of 4.2 percent, PALFINGER is one of the most research-active companies in Austria. 700 employees are engaged across 24 locations in integrated research and development to further strengthen our technological leadership. The focus remains on the digitalization of the entire product range.

Lifting Positive Impact

At PALFINGER, the sustainability program Lifting Positive Impact is a key component of the corporate strategy and the ongoing transformation. Much has already been achieved: Among other things, CO₂ emissions have been reduced by 17.6%

1) and work safety has been improved.

25-year anniversary on the stock exchange

In 2024, PALFINGER celebrated its 25th anniversary on the Vienna Stock Exchange. Since the IPO, the share price has more than quadrupled, impressively underlining the company's sustainable growth strategy. Since the beginning of the year 2025, the share price performance has also been very pleasing. The PALFINGER share has outperformed the leading ATX index.

Outlook 2025

Order intake in the European core markets is already recovering, which should also have a positive impact on earnings from the second quarter onwards. The management anticipates that the overall economic environment will continue to improve. The decline in earnings in the first half of 2025 is expected to be significantly compensated in the second half of the year, resulting in a strong year overall.

PALFINGER targets significant increase in turnover and profitability until 2027: a revenue of EUR 2.7 billion, an EBIT margin of 10 percent and a return on capital employed of over 12 percent.

PALFINGER's growth course of the last 25 years will continue in the future.

The PALFINGER AG Annual Report 2024 can be found here:

https://www.palfinger.ag/en/investors/publications/finance-publications

The magazine “Beauty of Transformation” that accompanies PALFINGER AG’s Annual Report 2024 can be found here:

https://www.palfinger.com/magazine

1) The emission values were corrected retrospectively for previous years (increase in emissions in 2023 by 4,782 t CO2e). One location was unable to provide evidence of the purchase of renewable energy in previous years. In 2024, this location was able to purchase renewable energy and thus make a significant contribution to reducing emissions (-12.4%). In addition, an emissions reduction of -5.2% was achieved from other measures.